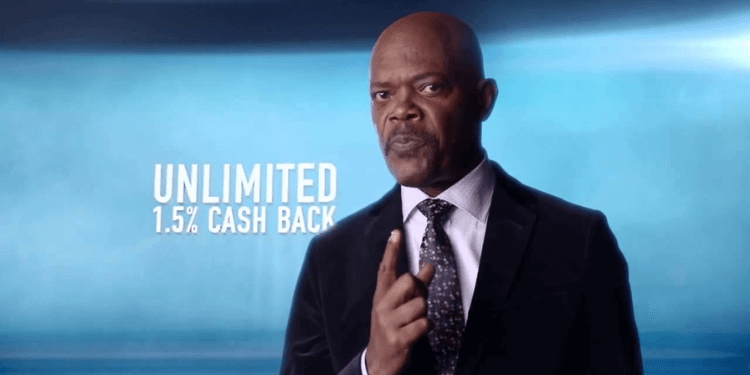

Capital One, known for its high-profile advertising campaigns featuring celebrities like Samuel L. Jackson and Jennifer Garner, has announced a monumental $35.3 billion acquisition of Discover Financial Services. This major move is set to redefine the credit card landscape, propelling Capital One to the forefront as the leading US credit card company by loan volume, surpassing banking giants JPMorgan and Citigroup.

This acquisition marks one of the most significant transactions in the banking sector since the 2008 financial crisis, highlighting Capital One’s ambitious strategy to expand its footprint in the financial services industry. By integrating Discover, a unique entity that both issues credit cards and operates its own payments network, Capital One aims to challenge the dominance of Visa and Mastercard in the payments arena.

Capital One’s CEO, Richard Fairbank, emphasized the potential of this acquisition to create a competitive payments network that rivals the industry’s biggest names. The deal also aligns with Capital One’s efforts to attract a more affluent customer base, building on its previous acquisition of the luxury digital concierge service Velocity Black. Discover brings to the table a desirable demographic of customers with higher credit ratings, complementing Capital One’s existing clientele.

Despite the strategic advantages, Discover has faced challenges, including a change in leadership due to compliance issues and a significant drop in profits in the last quarter. Moreover, the merger is expected to undergo rigorous examination from regulators, with concerns about antitrust implications and the impact on competition within the credit card sector. The Consumer Financial Protection Bureau, under Director Rohit Chopra, has already expressed concerns about market consolidation.

Capital One is optimistic about receiving regulatory approval and finalizing the deal by the end of this year or early 2025. This acquisition could significantly alter the dynamics of the financial services industry, offering consumers more choice and innovation in their financial transactions.

The acquisition of Discover by Capital One represents a bold step towards reshaping the competitive landscape of the credit card industry. While the deal promises to bring innovative financial products and services to consumers, it also raises important questions about market concentration and consumer choice. As the process unfolds, it will be crucial to balance growth and innovation with the need to maintain a healthy, competitive market that serves the best interests of consumers.