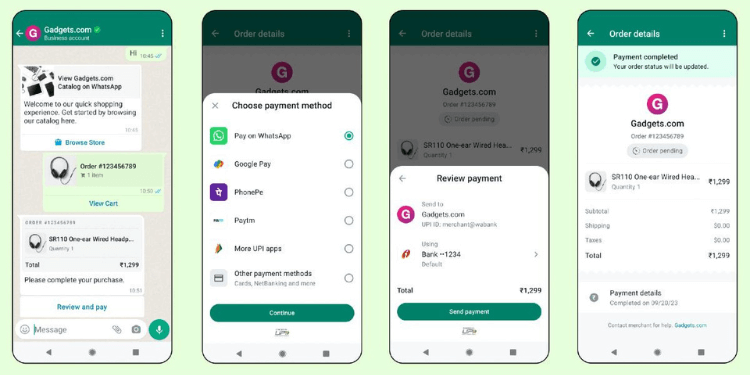

WhatsApp, the messaging giant owned by Meta, has launched a new feature in India that enables users to transact with businesses through various payment methods directly within the app. This move comes in collaboration with payment platforms PayU and Razorpay, now allowing payments via credit and debit cards, net banking, and all UPI-based apps.

This development shadows WhatsApp’s previous initiatives in Singapore and Brazil, where users were offered in-app business payment solutions. Meta’s CEO, Mark Zuckerberg, expressed enthusiasm about the launch during the Conversations 2023 event in Mumbai, emphasizing the ease of transaction it brings to WhatsApp chats.

Available exclusively for Indian businesses using the WhatsApp Business platform, this feature solidifies the app’s commitment to the Indian market, where it claims a staggering user base of over 500 million. Though WhatsApp introduced UPI-based payment services in 2020, it faces stiff competition from major players like Google Pay, PhonePe, and Paytm.

Before this integration, Indian businesses could only accept payments via WhatsApp Pay. But with this latest upgrade, the platform offers a more seamless transactional experience, accommodating various third-party payment methods, and further enhancing its service for merchants and users alike.

WhatsApp’s continued investment in the Indian digital payment ecosystem reveals a broader strategy to embed itself deeply in users’ everyday routines. By diversifying payment methods, the platform may have paved the way to challenge the dominance of established payment giants in the region.