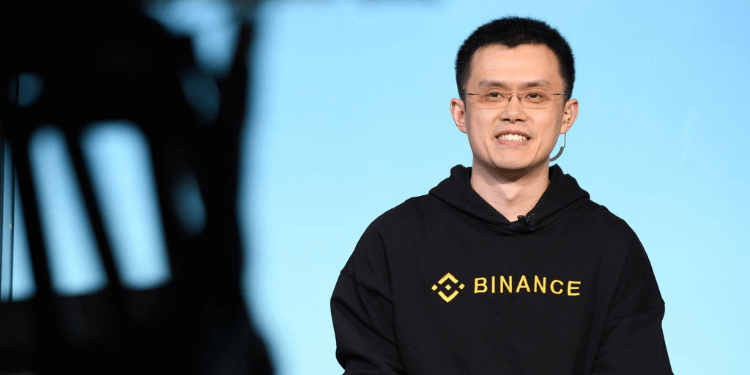

Changpeng Zhao, known as “CZ,” the CEO of Binance, the world’s largest cryptocurrency exchange, has announced his resignation amidst a guilty plea for money laundering charges, as per recent US court documents. This development sent Binance Coin tumbling by 6%, triggering a domino effect across the cryptocurrency sector.

The resignation is part of a settlement with the Department of Justice, which accused Binance of allowing traders in sanctioned countries like Iran and Russia to use its platform, thereby breaching US anti-money laundering regulations. Although Binance faces a hefty $4.3 billion fine, it will continue its operations.

CZ’s departure marks a significant turning point in the crypto industry. He established Binance in 2017 and rapidly climbed to prominence, competing fiercely with Sam Bankman-Fried (SBF) of FTX. The downfall of FTX, attributed in part to CZ’s actions, notably a tweet that led to a bank run on FTX, highlights the intense rivalry between these two crypto magnates.

Binance’s dominance in the market, accounting for two-thirds of global crypto trading, has often been seen as a stabilizing force, making its potential failure a significant concern for the industry. However, with CZ’s current location in the UAE, which lacks an extradition treaty with the US, he is unlikely to face jail time.

The dramatic turn of events for Binance’s CZ is a stark reminder of the volatile and unpredictable nature of the cryptocurrency world. It raises crucial questions about regulatory oversight and the future stability of crypto markets. For investors and industry players, this serves as a cautionary tale about the risks of regulatory non-compliance and the rapid shifts in leadership and power dynamics within the crypto sphere.